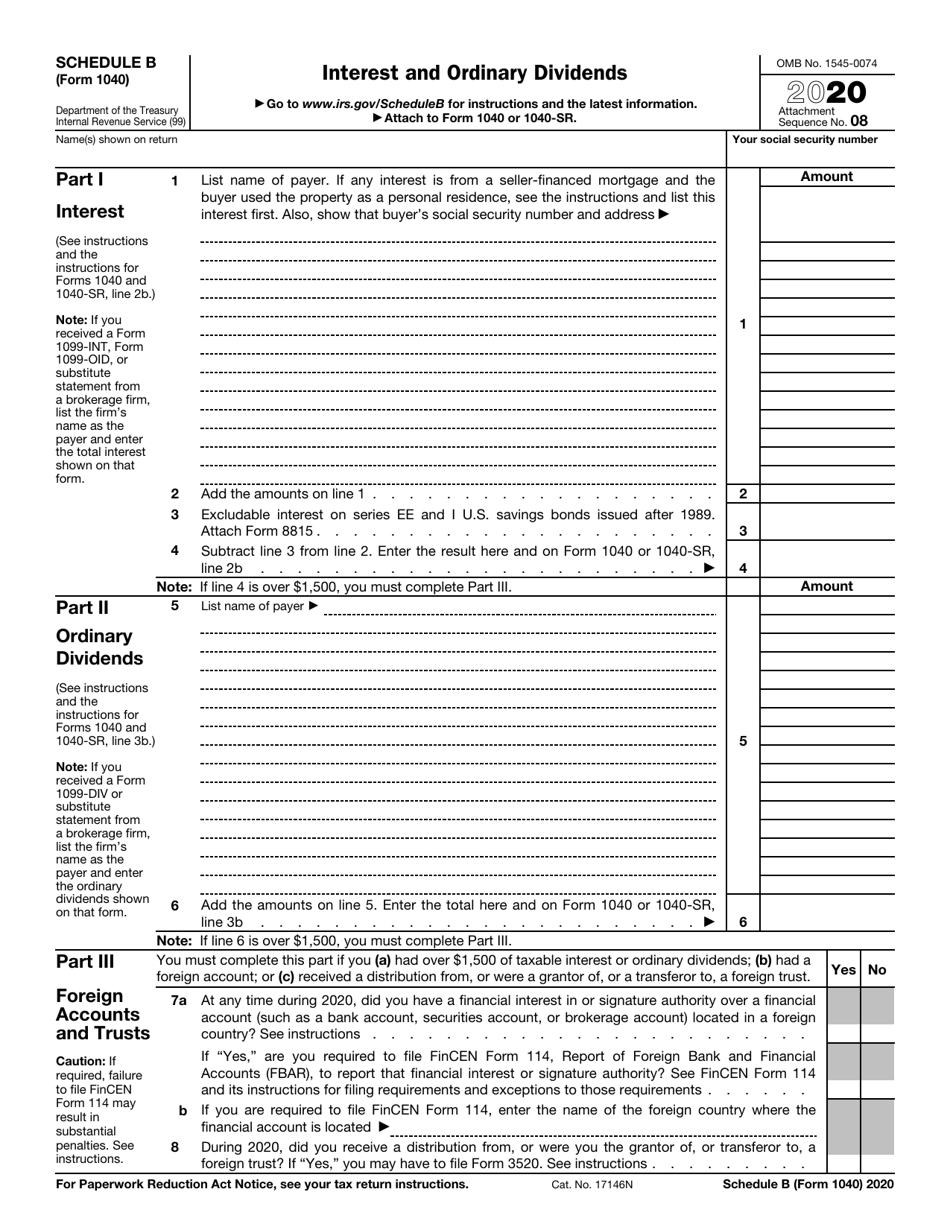

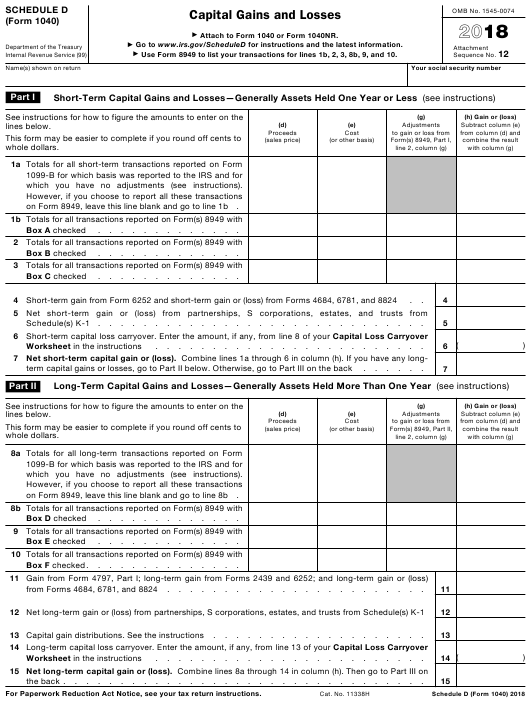

You may also be liable for accuracy-related penalties, which are a percentage of the amount of taxes due and can range from 20% to 75%. The IRS may charge you a late filing penalty if you fail to submit the form promptly. You may face penalties if you mistake or provide false information on your 1040 form. Possible Penalties for Failing the Form or Providing Fake Data Not claiming the right deductions and credits.Īdditional materials dedicated to filing instructions are available on.Not including the right forms, such as W-2, 1099, or other forms.Not double-checking the information you enter, such as names, Social Security numbers, and income.Sign the form and submit it to the IRS.Ĭommon Mistakes People Make Completing the Formįilling out the 1040 form can be tricky, and mistakes can lead to penalties.Once you have filled out all the sections, calculate your refund or the taxes you owe.You can choose from standard or itemized deductions depending on your situation. This is where you enter information about deductions, credits, and other tax benefits. After filling out your income information, move on to the deductions and credits section.You also need to indicate whether you received any tax-exempt income This includes wages, salaries, tips, dividends, capital gains, and other income.

This includes your name, Social Security number, address, filing status, and other details.

The IRS 1040 form is one of the most important documents an American citizen must complete yearly.

0 kommentar(er)

0 kommentar(er)